Irs Mileage Rate 2025 California Dmv

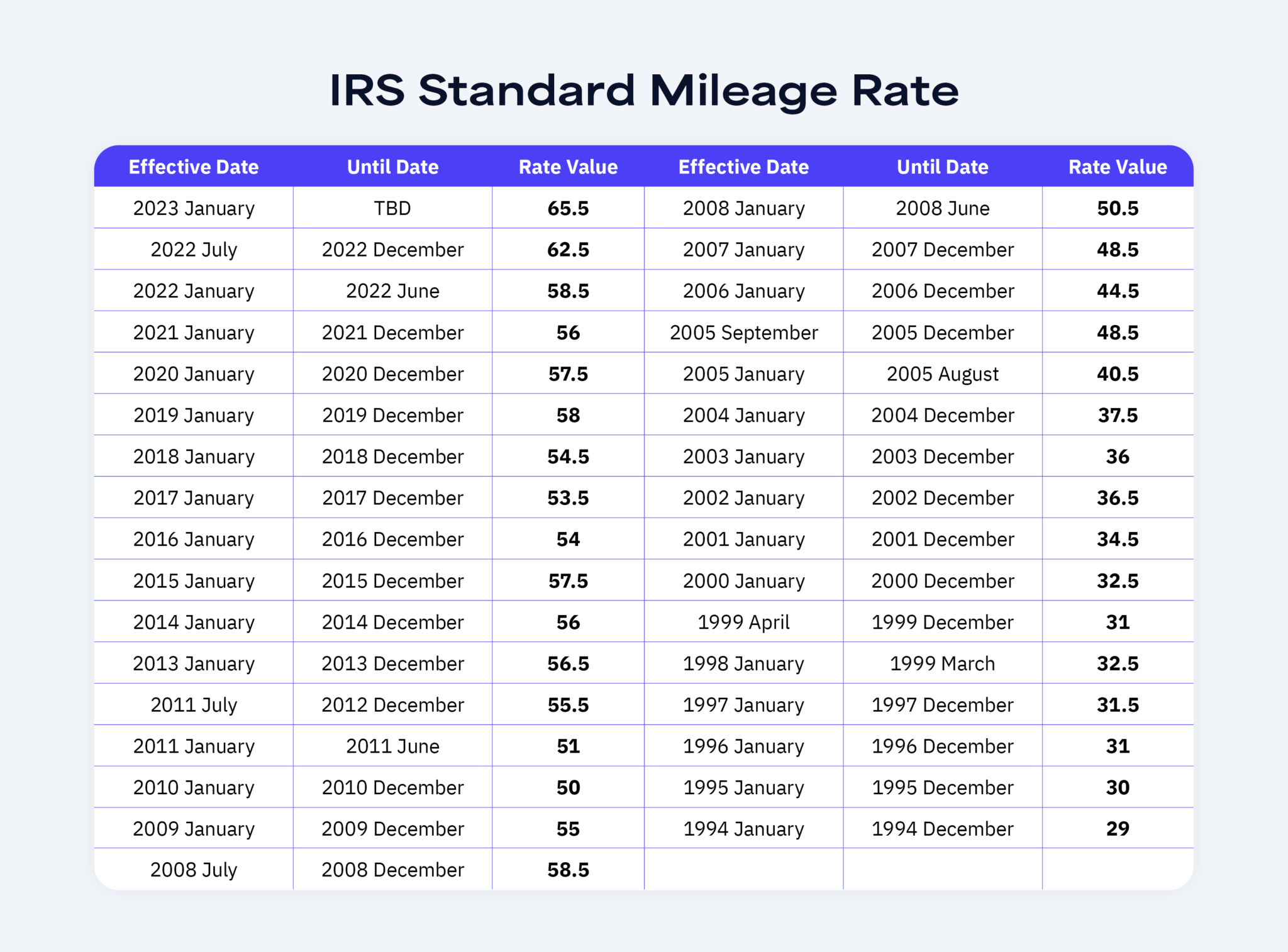

BlogIrs Mileage Rate 2025 California Dmv - IRS increases mileage rate for remainder of 2025 Local News, The new rate kicks in beginning jan. According to irs data, in 2023, the mileage rate for employing a vehicle for business purposes was 65.5 cents per mile. 2023 standard mileage rates released by IRS, The irs also announced its current mileage rate, which is 67 cents per mile for business purposes in the year 2025. Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

IRS increases mileage rate for remainder of 2025 Local News, The new rate kicks in beginning jan. According to irs data, in 2023, the mileage rate for employing a vehicle for business purposes was 65.5 cents per mile.

2023 IRS Standard Mileage Rate YouTube, May 14, 2025 updated 11:56 am pt. The irs is raising the standard mileage rate by 1.5 cents per mile for 2025.

IRS Mileage Rates 2025 What Drivers Need to Know, December 14, 2023 | kathryn mayer. 1, 2025, the standard mileage rate for the use of a car (also vans, pickups or panel trucks) will be:

California Mileage Rate 2025 Calculator Goldy Karissa, 14, the tax agency announced an increase in the standard mileage rate for business use of cars, vans, pickups, and panel trucks beginning jan. The standard mileage rate is 21 cents per mile for use of an automobile:

Irs Mileage Rate 2025 California Dmv. For medical purposes and moving for active military members, this amount is 22 cents per mile, and for charity purposes, it is 14 cents per. It’s expected that the irs will set a new rate.

.png)

IRS Issues 2025 Standard Mileage Rates UHY, The standard mileage rate is 21 cents per mile for use of an automobile: 67 cents per mile driven for business use 21 cents per mile driven for medical or moving.

Free Mileage Log Templates Smartsheet (2023), The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2023. Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

While minimum wages are increasing, the irs gave employees who drive for company business another present this holiday season:

Phillies City Connect Uniforms 2025 Year. Fox 2’s morning crew enjoyed a sneak peek, courtesy […]

What is the IRS mileage rate for 2025 Taxfully, An increase in the standard. 67 cents per mile for business purposes;

Rolling Stones Tour 2025 Presale Tickets. 29 at the hollywood bowl in los angeles, ca. […]